If you’re thinking about getting a company car then it’s more than likely you’ve come across the term Company Car Tax several times in your research.

Chances are, if you’re going to get a company car or van that you drive to and from your workplace, you’ll have to pay Company Car Tax

There’s actually quite a lot to Company Car Tax and if you’re new to the idea of it then it can be quite confusing. Being honest, even if it’s something you have some familiarity with it can seem complicated.

In April 2017, some new rules and regulations were introduced that are important to understand and it’s vital that you know how they will have an impact on you if you have a company car. In 2019 new rules were announced that become active from April 2020. These new regulations will benefit those who decide that they are going to get a company car that is either electric or a low-emission vehicle and we will be going into these in a little more detail later on.

What is Company Car Tax?

We are sure that now you’re here you have quite a few questions about Company Car Tax and what it entails, and that’s one of the questions we’re here to answer.

So, what exactly is Company Car Tax?

It’s pretty self-explanatory really, you get a Benefit-in-Kind, which you will often hear referred to as BiK, from your company (in this case your car) and you have to pay a tax on it. How much you need to pay will depend on three things:

- how much CO2 the vehicle you have been given emits

- the P11d value of the vehicle

- the tax bracket you’re in

If you’re in the higher tax bracket, then you’ll have to pay more in Company Car Tax. We’ll go into that in more detail later.

Company Car Tax is essentially a form of income tax that, once upon a time, was based on the price of the car and the mileage. However, in 2002, the way that we measure Company Car Tax changed to include how much CO2 a car emits. The inclusion of CO2 emissions was part of an attempt to encourage companies and drivers to use more environmentally-friendly vehicles.

Been searching for a new company vehicle? Get in touch with our team and they will help you find the car that fits your business needs.

When do I have to pay Company Car Tax?

If you have a company car or van that you also use for personal journeys which include travelling to and from work, then you will have to pay Company Car Tax.

There are a few exceptions, and these are:

- If you’re one of the Partners in a Partnership

- If you’re a member of a Limited Liability Partnership (LLP)

- If you’re a sole trader (you own your own business)

- If the company car has been adapted for mobility reasons

If you’re not doing personal mileage (including your daily commute) or the company vehicle is left on business premises overnight and is being used solely for business purposes – your vehicle could be considered a pool car – then you don’t have to pay Company Car Tax.

The government has announced that in April 2020 there will be changes to Company Car Tax, we will outline these pages below.

How is Company Car Tax calculated?

If you’ve established that you do in fact have to pay company car tax then you’ll need to know how it’s calculated.

Essentially, the amount you will pay will depend on the P11d value of the car, the CO2 emissions and your personal tax bracket. The lower the P11d value and the emissions = the lower your company car tax will be. You can find out exactly how much you will pay on websites such as ComCar.

If you would like to work it out yourself, you can use the formula below:

- Take the P11d value of the vehicle

- Multiply that by your Company Car Tax rate – this will give you your benefit in kind (BiK) rate

- Multiply your BiK rate by your personal tax rate (either 20% or 40%) – this is how much you will pay in Company Car Tax.

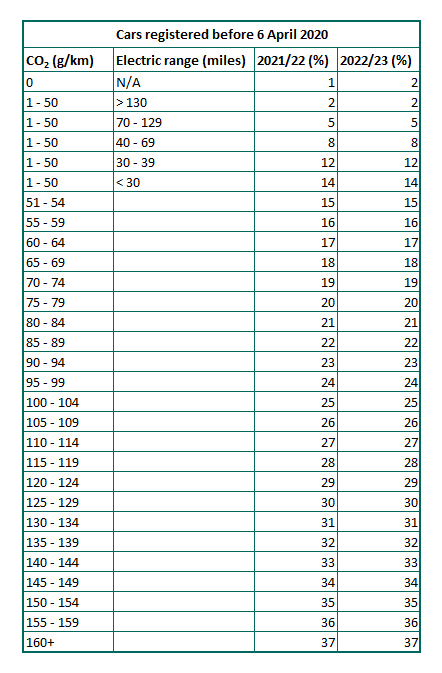

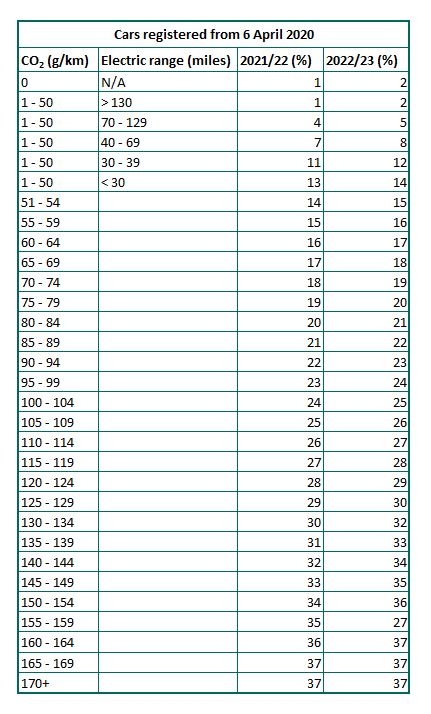

In 2016, the government announced some major changes to the BiK rates on cars to be introduced in April 2017. These changes included the introduction of more bandings for lower emission cars (such as hybrid and electric vehicles). The introduction of these newer bandings showed that vehicles with higher CO2 emissions could end up costing more than they would prior to April 2017.

Changes to BiK Company Car Tax 2020

In mid-2019, HMRC announced that it would be making changes to the bandings for Company Car Tax for 2020/2021. The most notable change was the introduction of a 0% rate for zero-emission electric vehicles (such as the ever-popular Nissan Leaf and the new Kia e-Niro).

In 2002, when the new bandings were first introduced for lower-emission and zero-emission vehicles, they were much rarer on the roads, so the rate wasn’t quite so generous as it will be from April 2020, and fewer bandings existed, this improved in 2017 and has improved again in 2020.

Which cars are the best for low Company Car Tax?

Looking at the tables above, it’s quite clear that when it comes to BiK are fully electric, or ultra-low emission vehicles are the best choice.

However, we acknowledge that electric vehicles aren’t for everyone. There are many reasons why you might prefer petrol or diesel with one of the biggest concerns being range anxiety. Electric vehicle ranges are improving and newer vehicles (such as the Tesla Model 3, Jaguar I-Pace and Audi e-Tron) can travel further on a single charge.

When you’re thinking about getting your new company car it’s also worth considering whether getting a van would be more tax-efficient for you and your business.

When it comes to Company Car Tax there are cars that will cost you less than others, these include (but are certainly not limited to):

- Nissan Leaf

- MG ZS

- Kia e-Niro

- Hyundai Kona

- Jaguar i-Pace

- Audi e-tron

- SEAT eMii

- BMW i3

- Volkswagen ID.3

- Hyundai Ioniq

- Toyota Prius

- Mini Countryman Plug-in hybrid (PHEV)

- Mitsubishi Outlander PHEV

- Porsche Taycan

Looking for a new electric vehicle? Have questions about range, cost, charging times? We have a guide for that. Download the FREE guide now.

What are the worst cars for Company Car Tax?

If you’re concerned about how much Company Car Tax you’re going to pay then the vehicles which emit the least CO2 are the best, so it makes sense that the models that emit the most CO2 will be the ones which incur the higher costs when it comes to BiK. There are a considerable number on this list, which include:

- SUVs such as:

- Range Rover Evoque

- Audi Q5

- Ford Kuga

- BMW X5

- Jeep Grand Cherokee SW

- Luxury vehicles such as:

Logically, the cars that will cost you the most in Company Car Tax are those that have a combination of high P11d value and high CO2 emissions.

Who pays for Company Car Tax?

Both you and your employer pay for Company Car Tax. As we mentioned earlier, it will come out of your salary the same as ordinary tax so you won’t have to worry about paying for it. However, we recommend you talking to your HR if you have any other queries.

So, that’s Company Car Tax. You pay for it like normal tax, and it’s based on your personal tax banding, how much CO2 your car emits and the P11d value of your chosen company car. It is changing, however, and you could end up paying significantly more for your company car if your BiK rate is lower than your income tax and national insurance contributions.

*All costs have been updated to reflect 2021 changes