- Introduction of WLTP

- Changes to Vehicle Excise Duty

- How will the 2020 VED changes affect me?

- How do I calculate how much first-year road tax has increased?

- What is NEDC?

In short, the changes to Vehicle Excise Duty will only affect you if you are registering a brand new vehicle with the DVLA after April 6th, 2020. There are several reasons why these changes have been introduced, though the core reason is related to the change from the New European Driving Cycle (NEDC) CO2 testing of vehicles on UK roads to the more accurate WLTP tests. The changes were proposed by the UK Government in 2018 with a start date of April 2020. In this article, we hope to explain why this change has come about, and how you can work out how much more it will cost you if you are registering your car this year.

You may be considering purchasing or leasing a brand new vehicle and, as part of your research process, you’re looking at the cost of Vehicle Excise Duty (which many refer to as road tax).

It’s possible that during your research you heard that, come April 2020, there will be some changes to the way that road tax will be calculated, yet when you’ve looked at the tables available on the government website you can’t see any changes in the prices that are being displayed.

So, if the difference isn’t in the actual band pricing, what exactly is this change that is set to happen at the start of the 2020/21 tax year in the UK?

It’s hardly a secret that there have been lots of discussions about real-world CO2 emissions from road vehicles; governments globally are looking at ways to reduce vehicle emissions, including the introduction of zero and low-emission zones in major congestion areas such as London, Rotterdam and Lisbon.

Looking for a new vehicle and thinking about going electric? Download our FREE guide to the electric vehicles available right now in the UK.

How do I calculate how much first-year road tax has increased?

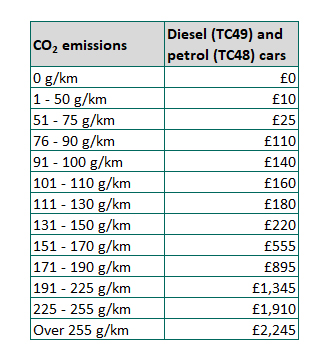

In order to calculate this, you need to take the WLTP CO2 emissions cost for your car and look at the chart below (or in our more comprehensive Vehicle Excise Duty article) and then subtract the NEDC CO2 value (also found on our handy chart below) and there’s the difference between 2019 and 2020 VED first-year payments.

Confused? Let’s explain how this will work in more detail.

What is NEDC?

Having been modernised in 1990 to include Extra-Urban driving cycle testing, in 1992, the New European Driving Cycle test was introduced in the UK as a way to measure vehicle CO2 emissions and the results for each vehicle were then connected to road tax price bands.

The NEDC was designed to assess the emission levels and fuel economy of passenger vehicles. As a test, it was supposed to represent the typical usage of a car driving on European roads. However, the NEDC has been repeatedly criticised for producing fuel economy figures that are unrealistic, a view that was echoed by consumer magazine Which? in an article titled Car Fuel Economy published in 2015.

In September 2015 a scandal erupted, which was initially focused entirely on the German manufacturer, Volkswagen. The investigation, launched by the US Environmental Protection Agency, accused Volkswagen of installing illegal manipulation devices in their vehicles that altered the carbon emissions readings for the cars. Volkswagen admitted to the charge, and the investigations have had a long term effect on the company, with many other companies outside of the Volkswagen Group becoming embroiled in the scandal that has since been referred to as Dieselgate.

Introduction of WLTP

In 2017, car manufacturers globally started to collect more accurate emissions information using a new and more reliable test, the Worldwide Harmonised Light Vehicles Test Procedure, better known as WLTP. The testing process has been refined further to include a Real Drive Emissions (RDE) test. In the RDE, vehicles are tested in real-world conditions to see if emissions in laboratory conditions are accurate. However, the only legally binding results are those that are created in the laboratory tests, and these are the ones that vehicles are judged by.

Due to the fact that WLTP reflects the real-world emissions of vehicles far more accurately than the tests conducted under NEDC, the CO2 emissions measured are usually higher.

Emissions levels for all vehicles sold in Europe after 2017 have been measured using both the older NEDC and newer WLTP tests.

Changes to Vehicle Excise Duty

In the Autumn 2017 budget, which was held on 22 November that year, the Chancellor announced that all new vehicles registered after April 2020 will be taxed based on their results in the more real-world relatable WLTP.

All vehicles manufactured for sale in Europe from 2017 onwards are tested using both NEDC and WLTP procedures. Despite the fact that the WLTP results are more accurate when it comes to CO2 emissions measurement, in the UK, results from NEDC testing are used to determine the bands that vehicles will appear in when it comes to Vehicle Excise Duty, and therefore, what costs an owner will pay for their vehicle.

When looking at the banding costs that have been outlined by the Government for Vehicle Excise Duty from April 2020, the costs haven’t changed, but if you aren’t driving an electric vehicle, it’s very likely that you will find your Road Tax costs increase this year.

In our article about Vehicle Excise Duty, we have produced tables that detail the costs you can expect to pay for your vehicle depending on its CO2 emissions.

As per the 2017 Autumn budget, from April 2020, Vehicle Excise Duty will no longer be calculated using the emissions determined by the NEDC. Instead, the results that are produced from the more real-world accurate WLTP will be used to identify which band individual vehicles will be placed in.

Looking to get a new vehicle? Contact our experienced team and get your journey started. Call us now on 01903 538835 or request a callback.

How will the 2020 VED changes affect me?

The changes to Vehicle Excise Duty will only affect you if you are purchasing, leasing or hiring a new vehicle that will be registered after April 2021.

As all vehicles since 2017 have displayed both the results from the NEDC and WLTP since the latter testing process was introduced, the information is readily available for review.

Below, we have an extract of a table showing the Vehicle Excise Duty bands from April 2021 and all related costs.

If you have questions about your vehicle CO2 emissions, the NEDC and WLTP results for models and different trims can be found on many manufacturer websites.

The Ford Fiesta has been the best selling vehicle in the UK for the last two years. The popular 3– and 5-door small hatchback, which has 68 different derivative options at present, has NEDC levels ranging between 92 and 136, which would currently place the car in 1 of 4 different bands.

Below is a table showing several of the first year bands for Vehicle Excise Duty for 2021/22.

Ford Fiesta

The Ford Fiesta 3-door Titanium X 1.0 I EcoBoost 70 kW / 95bhp, according to NEDC tests, has CO2 emissions of 94, which, if registered in 2019, would place the vehicle in band 5, meaning the Vehicle Excise Duty will cost £140 for the first year.

Under the new regulations, using the more accurate real-world WLTP results, this same model Ford Fiesta has CO2 emission levels of 117, this increase moves the car into band 7 which puts the cost for the first year for a new vehicle up to £180 from £130.

Audi

When tested using the NEDC system, the Audi A4 Avant 35TFSI Sport 150PS has CO2 emissions of 130, which places the car at the very top end of band 7. This means that, if the vehicle was registered prior to April 2021 the VED costs for year one would be £180.

However, when measured using WLTP tests, the vehicle emissions results are 156. This result takes the car into band 9 and means that if you are registering it after April 2021, your Road Tax for the first year will be £555.

Hyundai

Hyundai produces a wide range of vehicles with varying emissions levels. The hybrid Hyundai IONIQ 1.6 GDi SE Connect 141PS Blue Drive DCT (Automatic) NEDC results show that the hybrid vehicle emissions are a relatively low 83, which places it in band 4 with a first-year cost of £110 if registered before April 2021.

However, if you are in the process of purchasing a new Hyundai IONIQ that will be registered after April 2021, then your vehicle will be placed in a VED band using results from the WLTP tests and the figures are a bit higher. Emissions for the IONIQ are 103, which moves the car from band 4 to band 5, increasing the cost for the first year to £160.

.In summary, there are changes to Vehicle Excise Duty from April 2021. However, they will only affect you if you are registering a brand new car after 6th April.

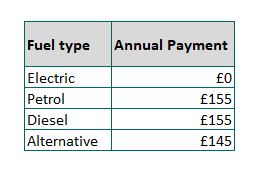

If you have purchased and registered your car before April 2020, then the price you pay will still be worked out using the NEDC test results. Only cars registered after the beginning of April 2020 will be affected by the Vehicle Excise Duty changes. If your vehicle is already registered then you will see no difference in your Vehicle Excise Duty, as payments for year 2 onwards are not changing as per the table below:

Have questions about the VED you’ll pay in your first year?

Make sure to ask our Vehicle Specialists when you call

*Costs in this article reflect payments from 6th April 2021. Changes to Vehicle Excise Duty were initially made in 2020.